CWIG Warns: Video-Recorded Statements by BAT Bank CEO to Face Legal Scrutiny

Jakarta, Otoritas.co.id – Statements delivered by Dato Sulaiman regarding the operations of BAT Bank have triggered serious concerns. Cerdas Waspada Investasi Global (CWIG) said the presentation contained high-risk narratives that could potentially mislead the public and expose new victims to financial harm.

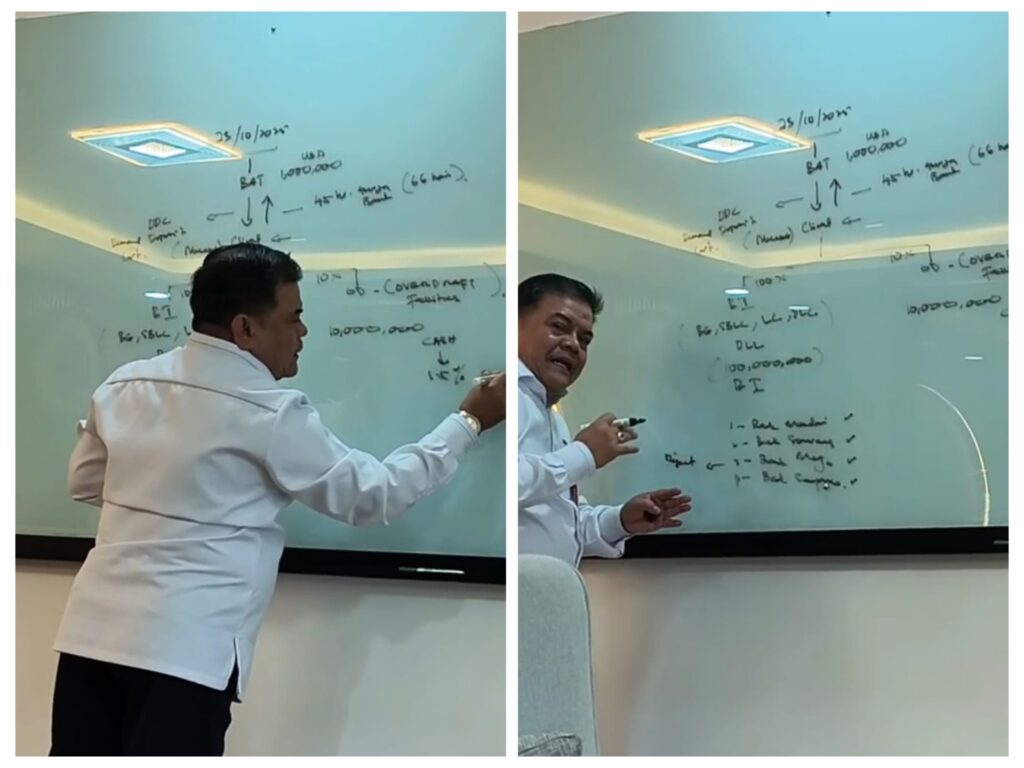

During the presentation, Dato Sulaiman outlined BAT Bank’s so-called Platinum Membership scheme, under which prospective clients are required to deposit USD 1,000,000. In return, BAT Bank claims to issue a Demand Deposit Certificate (DDC) to the depositor.

Under this scheme, clients are promised two primary facilities, both of which CWIG considers inconsistent with standard practices in regulated banking systems.

The first facility involves so-called bank instruments, including Bank Guarantees, Standby Letters of Credit (SBLC), Letters of Credit (LC), Bank Loan Certificates (BLC), and other instruments allegedly valued at up to 100 times the original deposit. CWIG noted that such claims lack reasonable precedent within legally regulated banking frameworks.

The second facility is an Overdraft (OD) arrangement, offering cash disbursement of up to USD 10,000,000, equivalent to ten times the deposited amount, with an interest rate of 1.5 percent per month. The funds were claimed to be disbursable within 45 working days. CWIG said the structure raises serious concerns, particularly in the absence of clear legal basis, identifiable liquidity sources, or authorization from competent financial regulators.

Dato Sulaiman further stated that fund disbursement could be routed through several major Indonesian banks, including Bank Mandiri, Bank Sinarmas, Bank Mega, and Bank Sampoerna, creating the impression that such arrangements had established internal banking pathways.

He also suggested that should difficulties arise with one bank, transactions could be redirected to another through internal coordination. CWIG described these statements as particularly concerning, as they could imply that Indonesia’s banking system is subject to informal intervention outside lawful mechanisms.

In addition, Dato Sulaiman claimed that most Platinum Membership clients originate from overseas jurisdictions, including Dubai, Pakistan, India, the United States, Switzerland, Australia, and Germany. BAT Bank was presented as offering a comprehensive package for foreign nationals, covering company incorporation in Indonesia, PMA establishment, KITAS processing, local bank account opening, and office facilities.

The most critical moment of the presentation, however, came when Dato Sulaiman openly acknowledged that USD 1,000,000 belonging to CWIG’s client, identified as JBI, remains under BAT Bank’s control.

This admission has prompted a fundamental question:

If the funds are acknowledged to be held by BAT Bank, why have they not been returned, given that none of the promised facilities have materialized?

Responding to the issue, Henry Hosang, Chairman of the Central Executive Board of CWIG, said the statements can no longer be viewed as a routine business presentation, but rather as indications that warrant formal legal examination.

Hosang emphasized that all statements made by Dato Sulaiman were fully recorded, structured, and repeated, and will be submitted as official evidence.

“These are neither assumptions nor opinions. They are statements made directly by Dato Sulaiman and captured in full. Once the funds are acknowledged to be held by BAT Bank, a legal obligation arises. In the absence of restitution, we are fully entitled, as the victim’s legal representative, to pursue legal remedies,” Hosang said.

CWIG also disclosed receiving credible internal information indicating that additional foreign parties are expected to travel to Indonesia to attend similar presentations and potentially be recruited as new Platinum Membership clients. CWIG warned that such developments could expand cross-border victimization and place Indonesia at reputational risk if left unaddressed.

Hosang stressed that CWIG’s actions are not intended as a prejudgment, but as a lawful preventive measure to protect the public. Legal proceedings have formally commenced through a final legal notice (somasi), positioned as a last opportunity for BAT Bank to return the funds in accordance with existing commitments and without conditions.

“If no good faith response follows this final notice, the legal process will proceed and all facts will be presented before law enforcement authorities,” Hosang stated.

He concluded by reaffirming that based on formal inquiries and confirmations from relevant authorities, BAT Bank is not listed as a licensed financial institution under Indonesia’s authorized financial regulators, raising serious questions regarding the legality of its fundraising activities and financial representations.